Their team seems to actually care about freelancers and small business house owners. They have superb scores, all the most effective cloud-based options, and just a few drawbacks. QuickBooks out-sizes them in the market, however FreshBooks supplies a superior expertise and will most likely have essentially the most improvements within the coming years. So it’s crucial to have good technical assist on any bookkeeping or accounting software program you choose.

- Includes project monitoring instruments in larger tier plans; has transaction tracking tags; lacks industry-specific reports; customers with a number of companies should pay for separate subscriptions.

- Discover how QuickBooks stacks up in opposition to Wave in offering features that cater to companies of all sizes.

- You ought to consult your personal tax, accounting, and legal advisors before engaging in any associated activities or transactions.

- Another free accounting software program to consider is Manager.io, a desktop-based platform for small to medium-sized companies.

The Rippling Group

The Time app contains the option for GPS monitoring, so you can keep observe of and coordinate with staff whereas they’re on the clock. It also features a geofencing possibility, which reminds staff to clock in or out at set locations. However their services differ considerably and serve significantly various kinds of companies. Evaluation their options and pricing to discover out which greatest meets your small business needs.

FreshBooks Lite’s reporting and invoicing features are more thorough than these included with QuickBooks Self-Employed, however QuickBooks consists of extra tax features. So if QuickBooks Self-Employed prices the identical as FreshBooks Lite, why did we label FreshBooks the more inexpensive provider? As A End Result Of https://www.quickbooks-payroll.org/ QuickBooks Self-Employed doesn’t have something to supply companies with a number of employees. Meanwhile, FreshBooks Lite is tailor-made in the direction of freelancers, solopreneurs, and small companies with employees on hand—basically, it packs extra of a punch for extra types of enterprise house owners. However FreshBooks incessantly presents excellent seasonal promotions that run from 60% to 70% off for the primary three months. FreshBooks additionally presents a yearly (rather than month-to-month) payment choice, which saves you an additional 10%.

Integrations

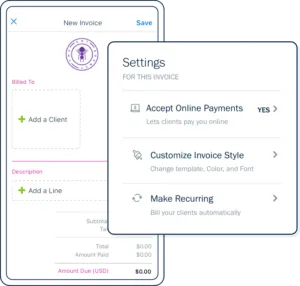

A new addition to QuickBooks provides this selection, while FreshBooks doesn’t supply it. Get cash circulate insights and overviews of project prices, pull month-to-month P&L reviews, generate stability sheets, and see expenses in tax-return-ready classes for the yr. Enable accountant entry to simply share data with your accountant for tax assist or monetary insights throughout the year. The key feature for a lot of enterprise owners looking for online accounting software is the power to bill shoppers and receives a commission.

You’re additionally able to let shoppers retailer bank card info, access a client account portal and mechanically apply client credit. FreshBooks includes built-in time monitoring in each plan, letting you log billable hours and easily add them to invoices. QuickBooks requires a separate add-on, QuickBooks Time, at a further value of $20 per month and $8 per extra consumer. QuickBooks has more sturdy expense tracking tools, including financial institution reconciliation, detailed vendor administration and superior stock options.

On top of that, their tax preparation options are practically identical, with tax calculations and help for various tax varieties, together with an absence of tax forecasting and planning features. It covers the fundamentals, together with invoicing with bank and credit card fee capabilities, unlimited expense monitoring and estimate sending, and primary financial reviews. FreshBooks presents a lower beginning value at $21 per thirty days compared to $38 per thirty days for QuickBooks. FreshBooks’s Lite plan allows you to observe and arrange info for up to 5 billable clients, while the Plus plan increases that to 50 (and greater tiers permit unlimited clients).

For example, you probably can tell QuickBooks to routinely generate and send reviews to individuals via e mail on a selected schedule. You can either select from several templated workflows or create your personal from scratch. Granted, this characteristic is only included with the Superior plan, so you have to spend quite a bit to entry it. Both platforms permit you to generate reviews, however the FreshBooks reviews all have the identical simple and non-customizable format. These rigid stories can solely auto-populate from present data and may solely be altered by a quantity of primary filters.

Key Features Of Plugbooks:

This can result in new customers being overwhelmed, as there’s a lot to learn, particularly for non-accountants. Small business owners will have to take time to learn all of the features essential to run their firm and additional modules if they are required to scale up later on. In distinction, FreshBooks provides a easy to-set-up software with a more user-friendly interface.

These customizable stories and advanced level of reporting are particularly priceless for companies that want financial forecasting, detailed audits or compliance-ready documentation. Each FreshBooks and QuickBooks supply invoicing, but FreshBooks is designed with service suppliers in thoughts. It contains polished, customizable invoices, recurring billing and features like automatic late fees and shopper portals. QuickBooks’s invoicing is more targeted on integration with bills and reporting. Here’s a fast overview of a number of the other quality small enterprise accounting software options available today — like Xero, Zoho Books, and FreeAgent — and the way a lot they cost in comparison with FreshBooks’ plans. If you run a product-based enterprise, the power to trace inventory and integrate it with your accounting software program is a huge plus.

Which means you need a small business accounting answer that can connect to different important tools in your small business. It’s additionally essential to do not forget that each FreshBooks and QuickBooks do have choices to add and/or manage contractors—which may be your first set of staff members anyway. QuickBooks doesn’t allow you to add team members until you stage up to their essentials plan. And whereas there’s no extra cost on that plan for a number of users, you’re maxed out at 3.

As Soon As an estimate is accepted, you’ll be able to convert that estimate into an invoice, which is a very cool characteristic to streamline your process and get you paid a bit faster. FreshBooks may also retailer and arrange your invoices so that you by no means surprise which ones have been sent, paid, or are overdue. For starters, their least expensive plan—labeled for Freelancers—is known as QuickBooks Self-Employed and starts at simply $10/mo (with 30-day free trial). Like FreshBooks, QuickBooks has a variety of plans tailor-made to fit the needs freshbooks desktop of your organization now—with the ability to regulate later as wanted.